US Best Credit Solutions

Nationwide Credit Restoration & Education

1-844-204-1155

Best Credit - Best Life

US Best Credit

Solutions Inc.

Legal Credit Solutions for Financial Freedom - Best Credit Repair Companies in the US

Our credit experts at US Best Credit Solutions are working diligently to maximize the benefits of consumer laws like The Fair Credit Reporting Act and The Fair Debt Collection Practices Act, enabling you to have the best credit scores and the best life!

We don't offer only credit repair services like most of our competitors because their results are limited and not permanent.

We offer Legal Credit Restoration and Credit Education Services, Mortgage Solutions and a 100% Money Back Guarantee!

We will put you in the position to accomplish all your financial goals and save thousands of dollars in the process.

Contact us today for a free consultation!

1-844-204-1155

Satisfaction & Reputation

Attorney on Staff

Military Discount

100% Legal

Your satisfaction and our reputation are our #1 concern. Please use the company's full name when researching.

We always have a licensed attorney on staff who offers best legal credit solutions to ensure maximum results in a timely manner.

We honor all who serve for our country and we salute our troops! Please ask about our military discount.

We are 100% legal

and are licensed, legally bonded & registered with the Secretary of State for your protection.

Our Cost

Congratulations on taking the initiative to restore your credit rating and accomplish your goals.

Now you just have to decide on whom to trust with this very important task.

Cheap companies will entice you with their low prices but they work only at the Credit Bureau level and the few items deleted will be re-reported by the original creditors. You will not get your money back because most of them are not legally bonded and registered businesses. Others will lure you in with a low monthly fee but they will not fix your credit to keep you paying and you will end up spending double of what we charge.

As one of the best credit restoration & repair companies, we will actually restore your credit, therefore your investment is based on the exact amount of work it takes.

Happy clients send us referrals, that's how we succeed on the long run. Stop wasting money on rent – Own your home.

Call one of the best credit fix companies today so we can give you a free credit repair consultation. and get the ball rolling for you.

WHY US BEST CREDIT SOLUTIONS?

At US Best Credit Solutions, we have more than 25 years of experience and want to improve the quality of your life. We are licensed, bonded and registered with the Secretary of State for our clients protection. Our clients satisfaction and our reputation are the number one priority at US Best Credit Solutions, and we have a 100% money back guarantee policy. We can permanently delete your financial past and help you move forward to reach the goals you have always dreamed of!

WHAT OUR CLIENTS HAVE TO SAY

Tulsa, OK

"My wife and I were referred to US Best Credit Solutions by our loan officer. Best Decision we ever made!"

Phoenix, AZ

"I just wanted to take some time to say thank you to the entire staff of US Best Credit Solutions."

Corsicana, TX

"US Best isn't just a bunch of lip service, you guys really did wonders with my bad credit."

Read More Testimonials

RECENT BLOG POSTS

Avoid These Common Pitfalls When Aiming to Improve Your Credit Score

Credit repair involves removing or correcting any inaccurate information from your credit report so that

Do Medical Bills Affect Credit Scores?

Staying healthy is essential to living well, yet medical bills can wreak havoc on your finances.

Understanding Credit Utilization and Its Impact on Your Credit Score

Credit cards can be helpful tools in establishing a credit record and a credit score. But you must be mindful of how you use them.

REQUEST YOUR FREE CONSULTATION TODAY

We offer free advice and legal credit solutions nationwide!

Get educated and learn about credit restoration today!

Call now for your FREE consultation!

1-844-204-1155

Request Consultation Online

BUSINESS IS GROWING

J O I N O U R W I N N I N G T E A M!

US Best Credit Solutions is committed to changing your life by improving your credit score.

Many of our competitors merely offer credit score repair services that often yield limited and temporary results. We are different. As a full-service credit restoration company, we provide comprehensive legal credit restoration and credit education services—all underpinned by a 100% money-back guarantee!

Our team of credit score repair professionals works tirelessly to fully leverage consumer protection laws such as The Fair Credit Reporting Act and The Fair Debt Collection Practices Act to ensure that you achieve the biggest possible improvements. We’re honored to be among the best credit fix companies in the country, and our ultimate goal is to empower you to reach all your financial objectives while saving you money in the process.

How are credit scores calculated?

Understanding how to raise your credit score starts with knowing how these scores are calculated in the first place.

Credit scores are calculated using various pieces of data from your credit report. FICO and VantageScore and the two most common scoring models. And while they use similar criteria, their weightings can differ slightly. The FICO model breaks down as follows:

- Payment history (35%) - This is the most significant factor. It includes on-time payments, late payments, the frequency and recency of missed payments, and public records such as bankruptcies and tax liens.

- Amounts owed or credit utilization (30%) - This refers to how much of your available credit you're using. Keeping your credit card balances low and paying off debt rather than moving it around can improve this aspect of your score.

- Length of credit history (15%) - This measures the average age of your credit accounts, as well as the age of your oldest and newest accounts. A longer credit history is generally better for your credit score if you've consistently made on-time payments.

- Credit mix (10%) - This refers to the range of credit types you have, such as credit cards, retail financing, installment loans, and home mortgages.

- New credit (10%) - This includes recently-opened accounts and recent inquiries from companies you've applied to for credit. Opening several new credit accounts in a short period can signal greater risk and potentially lower your score, especially if you don't have a long credit history.

Note that these percentages provide a general guide but may vary based on the specific calculation method and your individual credit history.

Is it possible that your low credit score is not your fault?

Yes, it’s possible.

You probably already know that late payments, delinquent student loan payments, bankruptcies, repossessions, and foreclosures can cause your credit score to take a beating. But did you know that some factors are beyond your control ? There could be errors in your records, causing your score to plummet.

After all, three major credit reporting agencies maintain files on approximately 220 million American consumers. Despite their earnest efforts to keep these records accurate, the vast number of files leaves a significant margin for error.

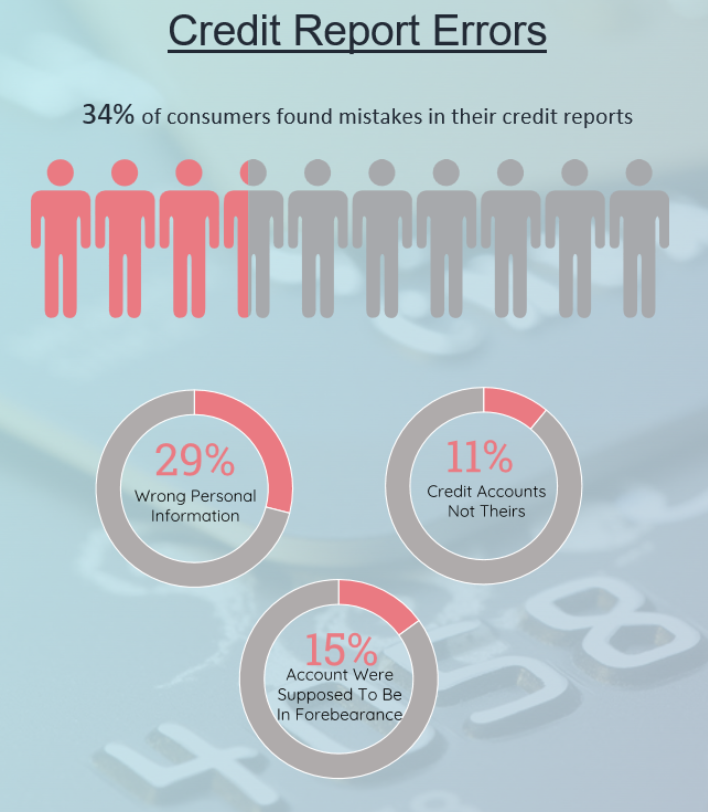

A recent investigation by Consumer Reports found that roughly 34% of consumers came across at least one error on their credit reports. Personal information inaccuracies—such as wrong names or addresses—were discovered by nearly 29% of consumers, with over half of these mistakes involving incorrect addresses.

About 11% of consumers also reported finding unfamiliar accounts on their credit reports, indicating errors related to account information. Furthermore, approximately 15% of consumers with accounts in forbearance noticed that one or more of these accounts were not reported as "current," as required by the CARES Act. This was particularly relevant for student loan payments, which were paused but scheduled to restart on October 1, 2021.

Credit bureaus are not the primary source of errors on credit reports. Instead, these errors often arise from data providers such as banks, creditors, and collection agencies inadvertently supplying incorrect information. Further errors can arise when credit bureaus mistakenly amalgamate the files of two consumers. This is common among individuals with similar names and addresses. And finally, some errors on credit reports can be a consequence of identity theft and fraud.

Even though everyone has the ability to rectify their credit score errors on their own, the complexity of the process leads many consumers to share the burden with a credit restoration company.

Why should I fix my credit score before getting a loan?

Creditors use your credit score to gauge your likelihood of repayment. Your credit score impacts the interest rates you receive, so creditors are not incentivized for you to have a high score. In fact, they prefer a scenario where they’re confident that you’ll repay them, but your score is still low enough to justify higher interest rates. This is why improving your score before taking out a loan is crucial. You have to look out for yourself because creditors are not on your side.

Regrettably, only about 20% of consumers make it a habit to request copies of their credit reports every year. It's crucial to review these documents yearly for potential errors, but data suggests that only around 44 million Americans make this effort.

What are the repercussions of a low credit score?

A low credit score can negatively affect various aspects of your life:

- Difficulty in obtaining credit approval - Lenders often perceive individuals with poor credit scores as high-risk borrowers, making it challenging to get approved for credit. Since banks and other financial institutions have strict eligibility criteria, it becomes hard for people with poor credit scores to get a loan or credit card approved.

- Higher interest rates and stringent conditions on loans and credit cards - Some lending institutions may relax their guidelines and approve credit products for individuals with poor credit. However, to balance their risk, they typically impose higher interest rates.

For example, for a $25,000 car loan, a person with a ‘fair’ credit score of 600 might get a 16% interest rate, compared to a 4% rate for someone with ‘good’ credit.

The higher interest rate means that over the life of the loan, the person with the 'fair' credit score will pay back a lot more money in interest. Even though both people borrowed the same initial amount ($25,000), the person with the lower credit score will end up paying significantly more due for the same car.

- Increased insurance premiums - In most states, home and auto insurance providers use your credit scores as part of their risk assessment. They may view a poor credit score as indicative of higher risk and thus charge higher premiums.

- Difficulty renting a property - Many landlords conduct credit checks on potential tenants. They may not see your credit score, but your credit report can reveal your payment history and other details. This is why applicants with poor credit are often less likely to be approved for a lease.

- Potential impact on job opportunities - With your consent, employers can check your credit report and use this information in their hiring decisions. While some states have restrictions on using credit information for hiring, not all offer such protections.

- Requirement of security deposit for utilities - Utility companies often conduct credit checks on new customers. If your credit history is poor, you may need to provide a security deposit to establish utility services.

If you're worried about your credit score negatively affecting your life, remember that you can take proactive credit score repair measures to improve it. Contact our credit restoration company today for a free consultation.

What is the cost of having a low credit score?

A bad credit score can lead to loan rejections and difficulties securing apartment leases. Beyond the inconvenience, a poor credit score can also be extremely expensive. Even if you manage to secure a loan, your credit score largely dictates the interest rate you'll be given, meaning you could end up paying significantly more.

By keeping a healthy credit score, you can save a considerable amount of money over your lifetime. A good credit score can lower the interest rate on your car loan by 10% or even cut the interest you need to pay for your college degree in half!

Additionally, a good credit score could prevent you from being part of the 10% of jobless individuals who get turned down for employment due to poor credit. After all, approximately 33% of employers conduct credit checks on some prospective employees, while at least 16% carry out credit or financial checks.

Take back control of your credit score.

US Best Credit Solutions is one of the best credit fix companies in Texas today because of one simple reason: We deliver real results.

Boasting over 25 years of combined expertise in credit score repair and a deep understanding of our legal system, we have successfully helped thousands of consumers take back control of their finances.

Apart from the fact that our credit restoration company is licensed as a credit service agency, we also hold a $10,000 surety for each of our clients. This ensures that their investment is protected and our services are guaranteed.

Additionally, our credit restoration company is officially registered with the Secretary of State of Texas. Our dedicated attorney and legal team fight relentlessly for our clients' credit rights under Federal Law to deliver optimal outcomes.

1-844-204-1155

Contact & Location

US Best Credit Solutions, 1024 S. Greenville Ave., Suite 130 Allen, TX 75002 Toll Free: 844-204-1155

Local

469-480-8181

Fax

469-519-0217

info@usbestcredit.com

Hours of Operation

Mon - Fri: 9:00am - 7:00pm

Get Your FREE

Credit Consultation

Your privacy is protected, we will not share your information with anyone.